New Jersey finally got their act together and back in April the CRC gave a handful of medical operators the green light to start selling to the public so long as supply for the state's 130,000+ registered patients.

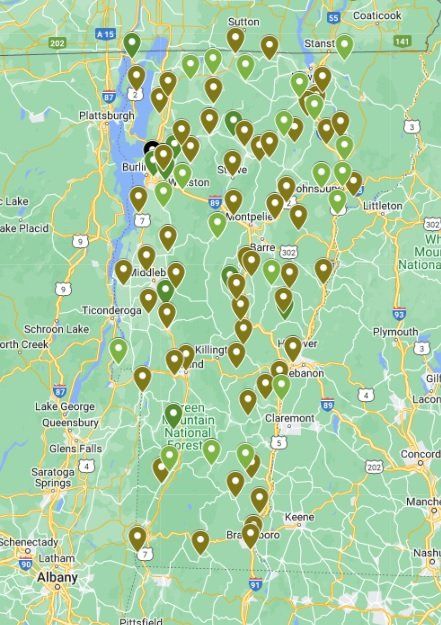

There are 18 stores currently selling adult-use as well as newly tax-free medical cannabis (see map below) and some are saying that the anticipated supply crunch has long since begun.

Some single stores in northern NJ have the potential to do $30-$50 million annually and it is just a matter of time before the needs of the 6 million adults 21 and older are met with competitively priced, quality cannabis. Ascend topped $1,210,000 in their Rochelle Park location's best week.

On the Social Equity and Diversity front, the CRC's Jeff Brown said they have granted 308 conditional licenses , including 110 retailers, 130 cultivators, 68 manufacturers, the latest of which shoiuld be officially announced shortly.

Annual licenses, with lower priority than their SE counterparts, number 240 and are in a unfortunate holding pattern, much to the chagrin of potential operators.

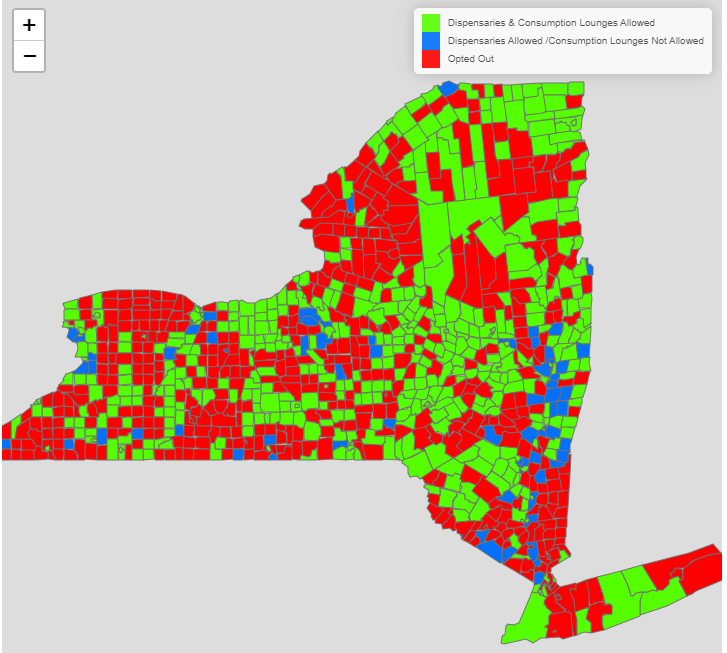

Rules for delivery applicants are due by year's end even the 486 municipalities that are still opted out of any Class 5 cannabis retail licensing will have operators delivering cannabis to their cities and townships.